Measuring the impact of TV advertising used to be a guessing game that was often associated with the 100-year-old quote, “Half the money I spend on advertising is wasted; trouble is I don’t know which half”. As a result, TV wasn’t seen as an outcome-based media, more of a tool to deliver reach and frequency rather than measurable RIO’s.

Advanced TV, new technology, targeted audiences

With Broadcast TV now only representing 21.6% of viewership, advertisers looking for digital media-like accountability have been longing for new options for their TV budget - not only to measure the impact of TV media, but to target consumers more accurately. The solution? Advanced TV.

What Advanced TV?

Addressable TV, Convergent TV, Linear and Over the Top (OTT), and Streaming are all terms that fall under the Advanced TV umbrella. What they all have in common, is that they offer marketers a higher level of targeting when compared to traditional broadcast media. So long, rabbit ears or rooftop antennas. Hello internet, 5G and live streaming.

How Does Advanced TV work?

Just like computers and smartphones, newer “Smart TVs” and cable boxes also have IP addresses and data collection hardware and software. This allows marketers to capture viewership data more easily, meanwhile delivering content on a one-to-one basis, using technology that’s closer to digital media when compared to one-to-many broadcast media format. The biggest category, Streaming TV, which includes Smart TVs as well as hardware like Roku, Apple TV and Amazon Fire Stick commanded the largest audiences, representing 34.8% viewership in July 22.

The growth in consumer adoption of smart TVs and hardware, combined with advertisers’ demand for more precise targeting and measurement, has attracted the attention of Wall Street and also many innovative companies like Austin TX based MNTN. MNTN has the financial backing of some of the biggest investment banks like BlackRock and Fidelity, and the company has Hollywood hunk Ryan Reynolds on their leadership team. More importantly, they have created one of the first self-service streaming TV advertising platforms. Just like digital media, advertisers can purchase media programmatically, targeting individual shoppers at a household IP level. Performance can be measured on their platform with the help of conversion pixels, along with easy connections with existing measurement tools like Google Analytics.

Another significant player in advanced TV is New York-based Cadent, who recently partnered with consumer purchase data provider Affinity Solutions to allow advertisers to target consumers based on their actual spending habits. Using real-time, fully permissioned credit and debit card purchases from Affinity combined with Cadent’s large source of national TV inventory including cable and OTT, gives shopper marketers the ability to target consumers based on purchase behavior giving them a clear view into how advertising drove sales.

Does all this sound like digital? It’s because it is digital – from programmatic buying to granular audience targeting and ROI accountability, digital tech has been wedged into a 70-year-old media channel and Advanced TV is garnering more share of ad dollars. The iab reported a 39% year-over-year increase of Connected TV between 2021 and 22 representing $21.2 billion in ad dollars.

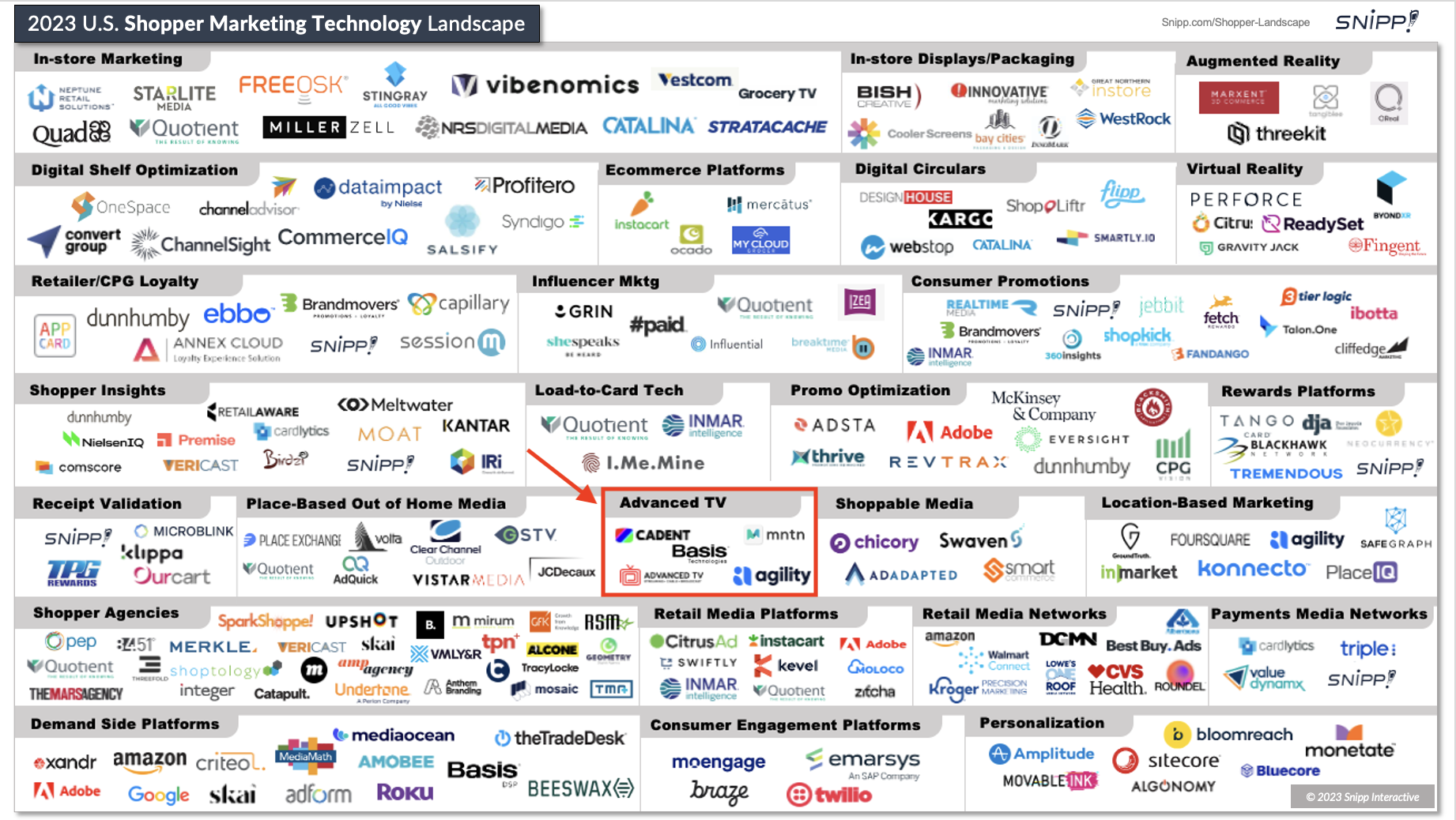

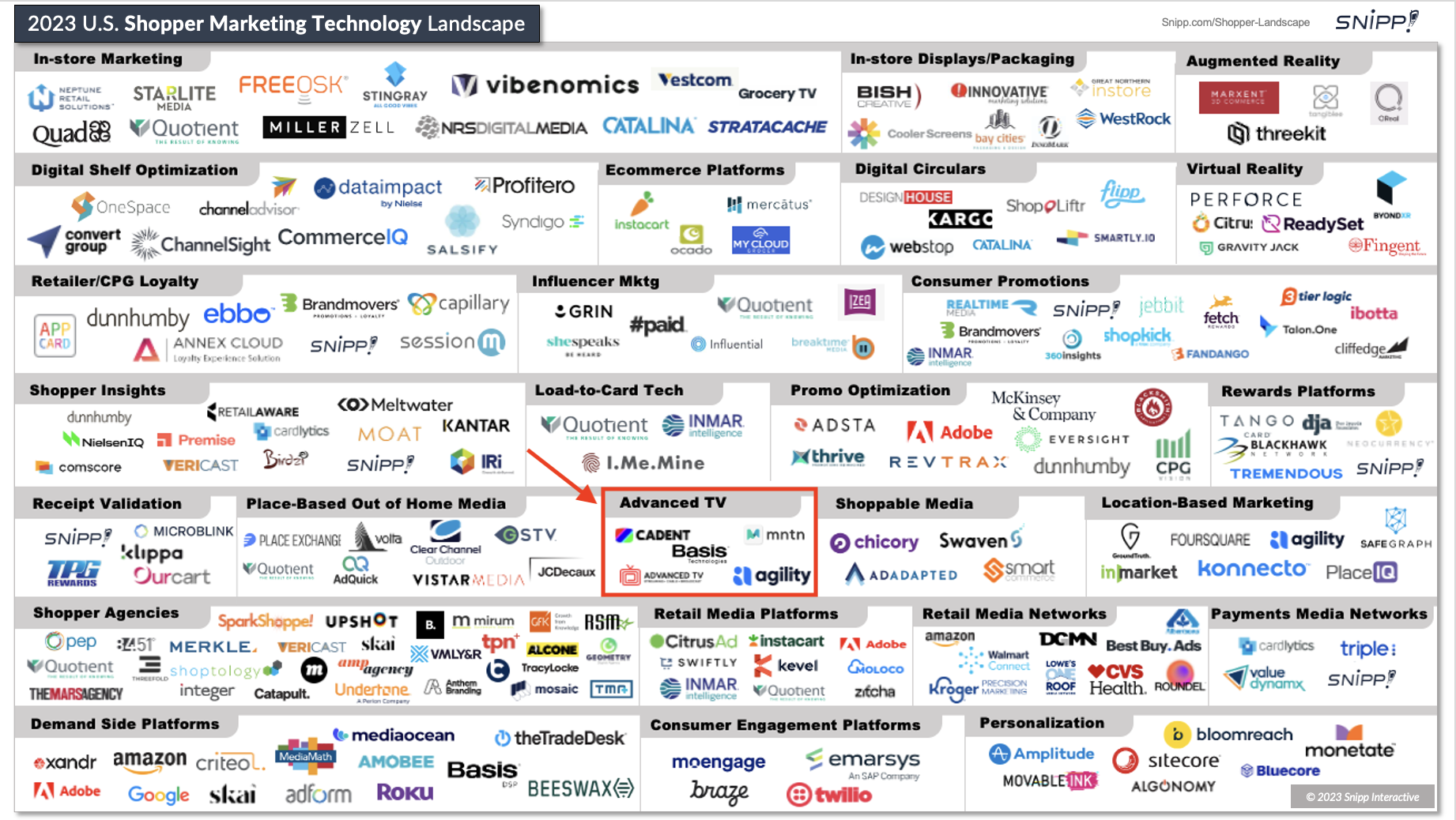

There are many other innovators in the Advanced TV space (as seen in the 2023 Shopper Marketing Tech Landscape) including:

- Basis Technologies - which brings together search, social, programmatic and CTV into a single platform.

- Agility - which offers full-service advertising including creative and ad delivery.

- Advanced TV which focuses on cross-device remarketing to drive conversions.

Note: Click to see the full Shopper Marketing Tech Landscape and associated details.

In the Advanced TV industry, there’s still a high degree of fragmentation when it comes to both campaign execution and measurement. Buyers often have to patchwork data sources in order to synthesize campaign results. One of the biggest initiatives that the Advanced TV industry is leaning into is creating standardization across media channels so that Connected TVs, set-top boxes and mobile and tablet ads can be interoperable. This way advertisers can create integrated campaigns that deliver media sequentially, from TV, to tablet and everything in between depending on the consumers' actions. Marketers can create unique messages for mobile, for example, that might be more promotional when someone is closer to making an in-store purchase, versus creating awareness at home on the large screen. The goal is to standardize the video assets regardless of format so they can originate from a single agency or tech provider and can track viewability, ad insertion and measurement for every impression served.

Simplification and normalization of ad buying, delivery and measurement will further streamline the process and drive increased investment into an already flourishing opportunity for brands.

Related:

Learn also about the nascent Financial Media Networks here.