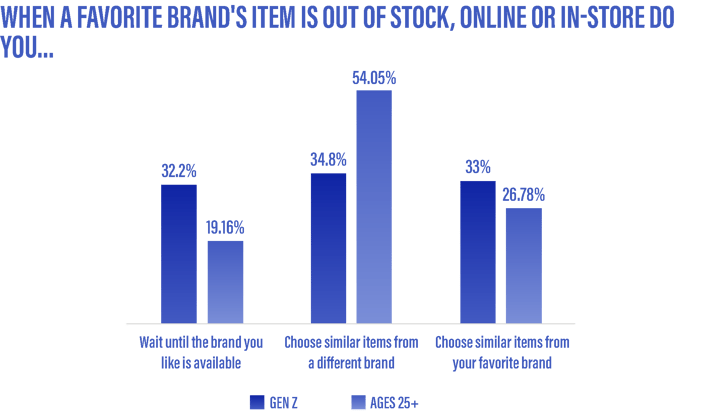

Findings - Out of Stock Purchasing

Gen Z consumers exhibit surprising levels of loyalty, as revealed in our recent survey, "Inflation and the Ever Evolving Shopper Dec 2022." When faced with out-of-stock situations, Gen Z individuals are less likely to choose alternative items from different brands at significantly lower rates. Instead, they prefer to wait until the brand they prefer is back in stock, showcasing their loyalty to their preferred brands.

Insights -

- Gen Z consumers are known for being well-informed and sometimes perceived as fickle shoppers, but they can be surprisingly loyal when they find brands that offer value.

- The data reinforces the notion that Gen Z values a combination of quality products and reasonable prices, as demonstrated in the previous question.

- Acquiring new customers is generally more costly than retaining existing ones, making it important for brands targeting Gen Z to focus on customer retention strategies.

- By prioritizing customer retention, brands can expect higher shares at checkout as Gen Z consumers reward brands that they feel provide value.

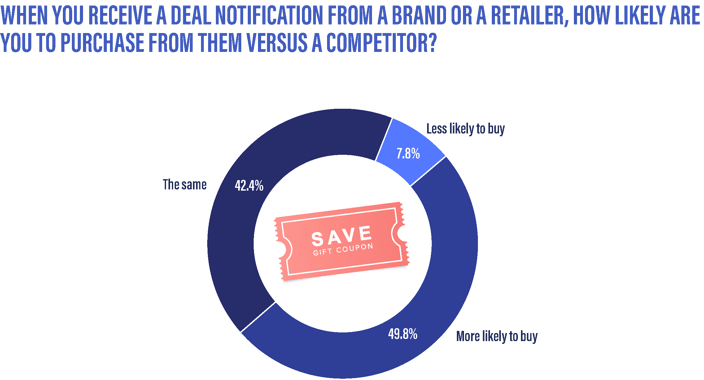

Findings - Offer and Deal Impact on Purchasing

Deals play a crucial role in driving sales, as highlighted by our survey findings. Nearly half (49.8%) of the respondents stated that they would be more inclined to make a purchase from their favorite retailer or brand compared to a competitor if they were presented with a deal. This emphasizes the significant impact that attractive offers and promotions can have on consumer behavior and their purchasing decisions.

Gen Z's shopping behavior is driven by an "all channels, everywhere, all the time" mindset, empowering them to seek deals and make purchases on their own terms, at their desired price points. To secure Gen Z's loyalty, marketers must provide rewards that align with their distinctive preferences. According to a recent study conducted by YPulse, the top factors that influence the effectiveness of a rewards program for Gen Z include:

- Getting specific discount codes and coupons (62%)

- Earning points that I can use for other things (61%)

- Getting a flat discount on all purchases (60%)

- Getting free stuff (58%).

Also, 31% of young people said they would stay loyal to a brand that gives them free things.

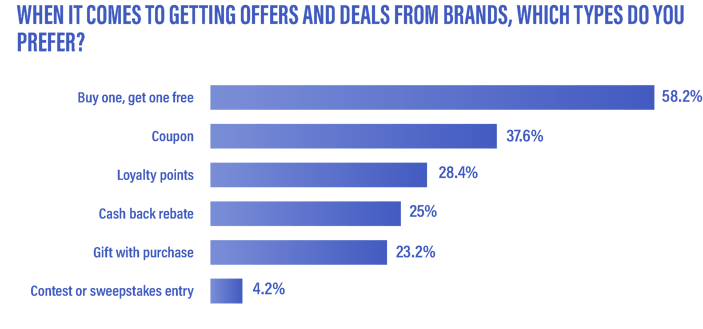

Findings - Offer and Deal Type Preferences

Gen Z prioritizes simplicity and value when it comes to deals and offers.

- Buy one, get one free (BOGO) is the most favored type of offer among Gen Z, chosen by 58.2% of respondents.

- Coupons are also popular among Gen Z, with 37.6% expressing their preference for this type of offer.

- Loyalty Points are favored by 28.4% of Gen Z respondents.

These findings highlight the significance of offering straightforward and appealing deals that cater to Gen Z's desire for convenience and cost-effectiveness.

- Deals and sales play a significant role in expediting Gen Z's path to purchase.

- According to a Holiday 2022 study by SimplicityDX, 28% of Gen Z respondents consider discounts and promo codes to be a key driver of their purchase decisions.

- 26% of Gen Z shoppers are more influenced by the overall shopping experience, while 15% pay more attention to social media views and likes.

- Marketers should continue collecting email data from Gen Z consumers as it remains valuable.

- Investing in Consumer Engagement Platforms with SMS capabilities can help marketers engage with Gen Z shoppers, bringing them closer to the point of purchase and driving conversions.

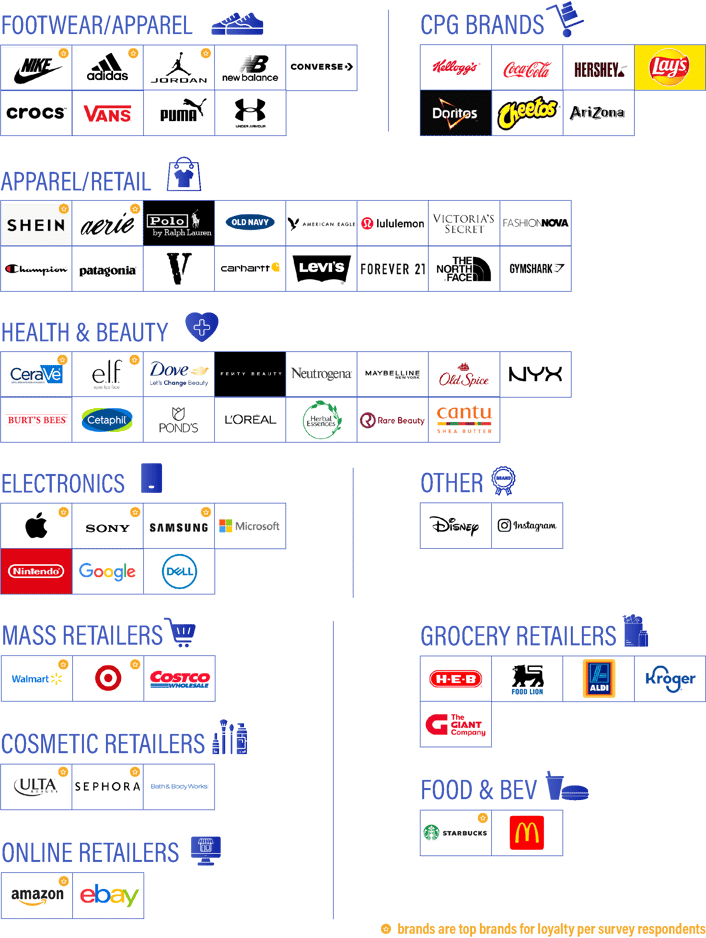

Findings – Brand Loyalty among Gen Z

- Nike was the most popular brand among the respondents, representing 13% of all mentions.

- Walmart received 5% of the mentions, followed by Amazon, Shein, and Apple, each with 4%.

- Adidas received 3% of the mentions, while Target, Jordan, Aerie, and Cerave each received 2%.

- Other mentioned brands included e.l.f. Cosmetics, Sony, Ulta, Samsung, and Starbucks.

- Various grocery retailers such as HEB, Giant, Kroger, Trader Joe's, Food Lion, Costco, BJ's, and Aldi were also mentioned.

- CPG brands like Kellogg's, Coca-Cola, Hershey's, Doritos, Cheetos, Kraft, Amy's Kitchen, Totino's, Hidden Valley, Monster Energy, Kroger's Simple Truth, and Walmart's Great Value private label brand were mentioned.

- Health and beauty brands included Cerave (with the highest mentions at 2%), e.l.f. Cosmetics (1%), Fenty Beauty, Neutrogena, Maybelline, Burt's Bees, Cetaphil, Ponds, Dove, L'Oreal, Rare Beauty, Clinique, Aveeno, as well as beauty retailers Ulta, Bath & Body Works, and Sephora.

Conclusion

In conclusion, this survey provided valuable insights into Gen Z consumer and retail trends, including the shopping preferences and brand loyalty of Gen Z consumers. Their shopping habits, preferences, and brand loyalty are shaped by convenience, cost-effectiveness, and value. By understanding and responding to their needs, marketers can foster strong connections with this evolving demographic and secure a higher share at checkout. The insights provided in this survey can serve as a valuable guide for brands and retailers seeking to engage effectively with Gen Z consumers in today's competitive marketplace.

Inside the Gen Z Mind

The survey results reveal new insights into the Gen Z psyche that will impact how you approach marketing to remain relevant. So read on to learn more! Or Download the full report here.