As global concerns about health and hygiene evolve, the home cleaning industry is experiencing significant changes. The pandemic prompted a major pendulum swing in our cleaning habits, during which time harsh chemicals perfumed our interiors and we liberally sprayed packages and surfaces with disinfectant. But over the past year, we've arrived at a new equilibrium – one that balances caution with sustainability, and cleanliness with wellness. The home cleaning industry is trying to find its footing in this revised landscape, where household cleaning products are expected to do more than just sanitize and remove dirt: consumers expect them to also serve as agents of well-being for their homes, personal lifestyles, and the broader environment. To that end, we are witnessing a huge shift towards being ‘green’ at home, with non-toxic items occupying more space in cleaning cabinets. This increase in demand for eco-friendly cleaning products, coupled with more stringent regulations, is set to spur more innovation in the market. But as these changes affect the home cleaning industry, brands will also have to contend with the macroeconomic environment’s enduring effect on consumers’ spending, with historically high inflation impacting prices and household budgets. To give brands and retailers a ‘crystal clear’ view of the home cleaning industry, we've polished up a fresh analysis of some pivotal trends and offered up some marketing strategies to consider!

The US and European home cleaning markets are expanding, with natural products leading the charge…

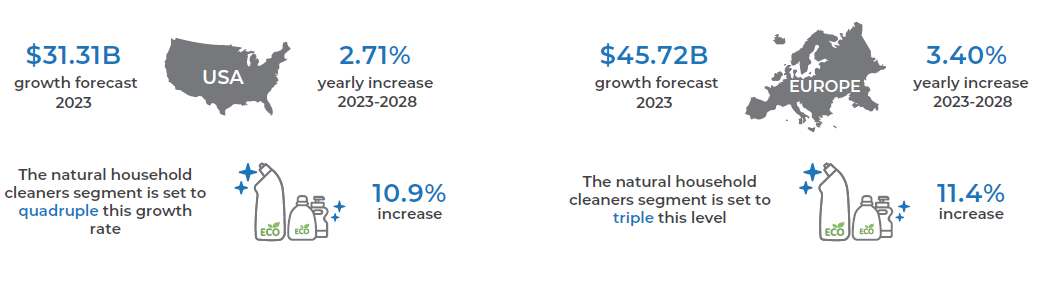

- The US home cleaning market is forecasted to reach US$31.31bn in 2023, with an anticipated yearly increase of 2.71% from 2023-2028. The natural household cleaners segment is set to quadruple this growth rate, with a projected 10.9% increase.

- The European home cleaning market is estimated to reach US$45.72bn in 2023 with an annual growth of 3.40% from 2023 to 2028. The growth of natural household cleaners in Europe is set to triple this level, with a projected increase of 11.4%.

…but prices in both regions have been impacted by supply-chain disruptions and record inflation.

- Numerator's Price Pulse found US Household cleaning products went up 21.9% in 2022 and experienced growth nearly five times over the year.

- In 2022, the Consumer Price Index (CPI) for household cleaning products in the US reached a record high of approximately 139.73 points, marking a two-decade peak for this category since 2000.

- Inflation in the EU tripled to a record 9.2% in 2022 from 2.9% in 2021, significantly impacting prices even this year due to increased input costs for brands:

- In France, cleaning products rose by 13.73% at the start of 2023.

- The UK saw cleaning products' prices skyrocket by 90% in supermarkets by June 2023.

.png?width=236&height=88&name=Coors%20light%20%20Tide%20Cleaners%20(1).png)