GroupM estimates that retailers collected over $100 billion in ad revenue from brand and vendor-funded Retail Media. What is retail media, how does it work, and how do retailers jump on this expanding opportunity?

Historically, retailers have had an abundance of first-party purchase data that has been used exclusively for their own marketing purposes. Retail Media, opens up that rich data to brands who can use it to target high intent shoppers in a privacy-compliant advertising ecosystem.

How Does Retail Media Work?

Retail Media works like this. Brand X launched a new, environmentally conscious diaper line at Walmart, which is one of their biggest accounts. They traditionally use digital media to drive awareness and retail sales but often waste media on the wrong target consumers – sometimes they use outdated third-party purchase data and reach mom’s whose kids are no longer wearing diapers and also, advertise to shoppers who don’t shop at Walmart.

With Retail Media, Brand X can advertise directly to Walmart’s shoppers on Walmart’s digital properties, including ecommerce and off-site across the open web, leveraging real-time purchase data to not only target earth-friendly diaper buying consumers, but also measure the impact of their media investment on actual in-store sales. Right audience, right time, right geography, plus a quicker understanding of what ads worked to grow their brand at a key account. Walmart is expected to collect $3.14 Billion in ad revenue this year.

So why isn’t every retailer capitalizing on this? The answer is simple. Retailers other than the larger players haven’t had the financial or human resources to build the capability in-house. A high-risk proposition for such low margin businesses.

Enter the Retail Media Solutions Providers

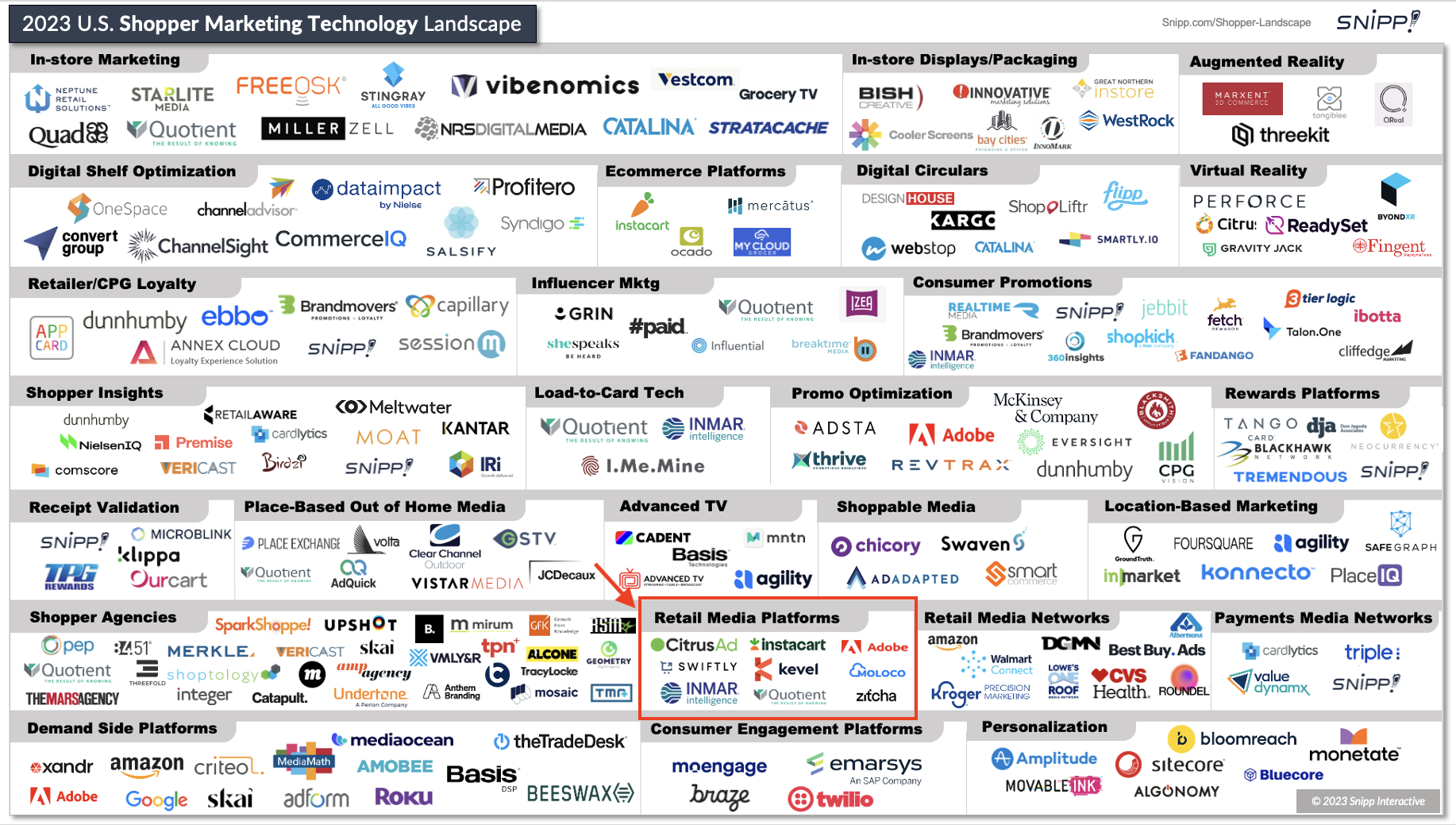

The solution? Enter the Retail Media Platform providers - Saas solutions developed by innovators that couldn’t help but notice the rapid rise in revenue from Walmart, Target, and Kroger. Companies like CitrusAd, Kevel and Criteo have helped smaller retailers allow their brand partners to access their shopper data and reap the rewards of both increased sales and incremental revenues. Our Shopper Marketing Technology Landscape shows many of the Retail Media solutions providers (see Retail Media Platforms - adding Swiftly, Inmar, Quotient, Adobe, Zitcha and Moloco to the list) along with other technology providers competing for the same dollars.

Note: Click to see the full Shopper Marketing Tech Landscape and associated details.

And the Results?

In one example cited by Criteo, they state that they were able to increase sales for an art materials brand sold at Michael’s Crafts by +412% with an increase in ROAS of +926% using two creative ad formats: Onsite Display ads and Sponsored products. This level of performance, transparency and measurably is unprecedented with traditional programmatic advertising leading brands to divert budget towards Retail Media.

Will brands shift their investments to retailers with Retail Media Networks, leaving the laggards out in the cold? Only time will tell.

Related:

Learn also about the nascent Financial Media Networks here.