TORONTO, ON, CANADA – Snipp Interactive Inc. (“Snipp” or the “Company”) (OTCQB: SNIPF; TSX-V: SPNV), a global provider of digital marketing promotions, rebates and loyalty solutions, is pleased to announce its financial results for Q1 2018. All results are reported under International Financial Reporting Standards (“IFRS”) and in US dollars. A copy of the complete unaudited interim financial statements and management’s discussion and analysis are available on SEDAR (www.sedar.com).

Q1 2018 Highlights

(Refer to Non-GAAP Measures, Gross Margin, EBITDA and Bookings Backlog discussion below)

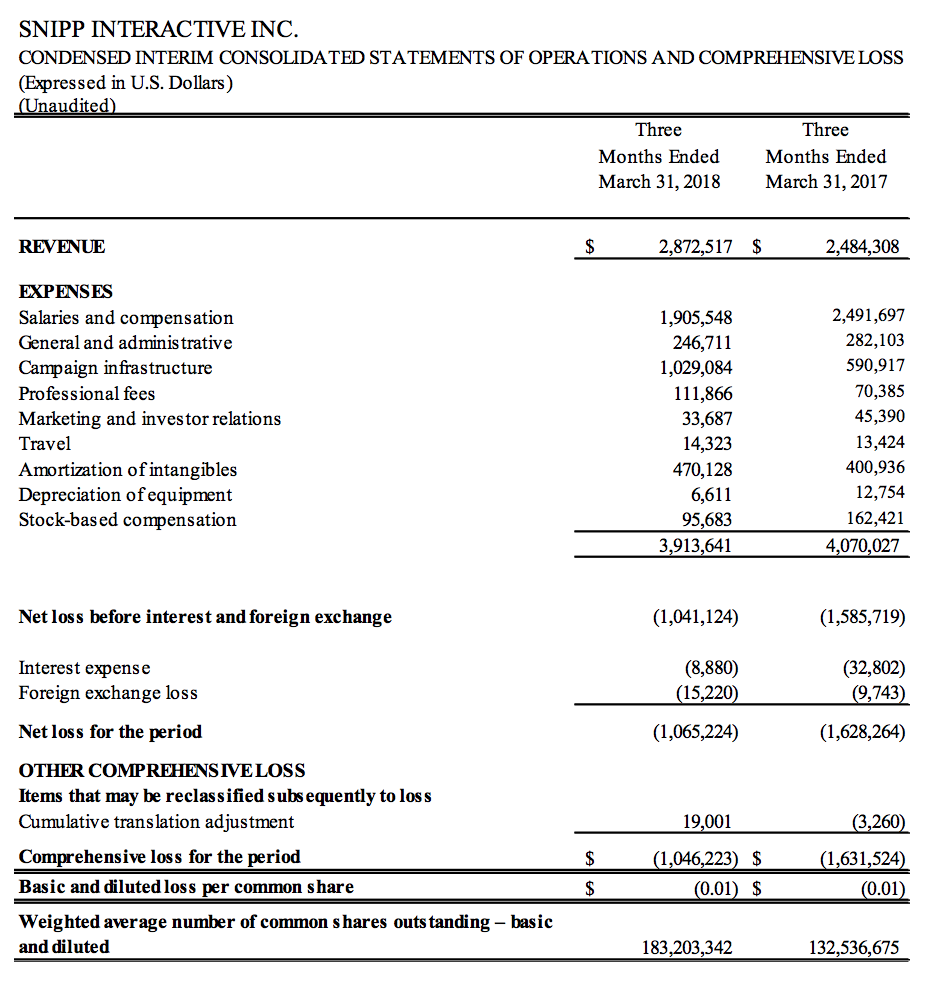

- Revenue for Q1 2018 increased by 16% compared to Q1 2017. Revenue for Q1 2018 was $2.87MM compared to revenue for Q1 2017 of $2.48MM.

- EBITDA in Q1 2018 improved by 54% compared to Q1 2017, an EBITDA improvement of $540,906. Q1 2018 EBITDA loss was $0.47MM vs Q1 2017 EBITDA loss of $1.01MM.

- Bookings for Q1 2018 improved by 25% compared to Q1 2017, an improvement of $0.76MM. Q1 2018 Bookings were $3.84MM vs Q1 2017 Bookings of $3.08MM

- Bookings Backlog stood at $6.3MM at March 31, 2018 [a 9% increase from Q1 2017] of which $5.5MM will be recognized over the remaining 2018 and 2019 fiscal periods. This compares to Bookings Backlog at March 31, 2017 that stood at $5.8MM of which $5.4MM was recognizable over the 2017 and 2018 fiscal periods. Previously the Company reported Bookings Backlog as future revenue to be recognized in the current fiscal year and the next fiscal year. The Company is now reporting Bookings Backlog as all future revenue including revenue that extends beyond fiscal 2019.

- Gross margin in Q1 2018 was 64% compared to 76% in Q1 2017. The decrease in margin was due to some promotions with higher associated reward components, which resulted in higher campaign infrastructure costs.

- The Company continued to focus on cost improvements from its integration efforts, resulting in the following Q1 2018 cost savings compared to Q1 2017:

- Salaries and compensation expenses decreased by approximately US $586k or 24%;

- General and administrative expenses decreased by approximately US $35k or 13%;

- Marketing and investor relations expenses decreased by approximately US $12k or 26%;

“We are extremely pleased with our Q1 results. Achieving both top line and bottom growth has been a goal we have achieved consistently over the last few quarters,” commented Atul Sabharwal, CEO and Founder of Snipp. “We look forward to the rest of 2018 as we focus on reaching sustained profitability and taking advantage of our steady stream of repeat customers. We are also excited by emerging strategic opportunities in both existing and new verticals.”

The Company also announces the departure of Ritesh Bhavnani from its board of directors and management team. Mr. Bhavnani will become a member of the Company’s advisory committee and will be engaged as a consultant to develop Snipp’s Artificial Intelligence and Machine Learning systems.

Mr. Bhavnani commented the following: “Having been instrumental in building our company and overseeing the integration of the technology platforms from our last two acquisitions over the last twenty-four months, the company’s platforms, process and leadership have matured to the point where my role can transition effectively to focusing exclusively on developing our Artificial Intelligence and Machine Learning systems. Also, with the recent birth of my first child, I found it challenging to effectively carry out my board and management responsibilities at Snipp, especially given the time zone differences between India, where I live, and North America, where the rest of Snipp’s core management team and board is located. My new role allows me to remain connected to Snipp and committed to its success by focusing on core areas of technology development for the Company. I will continue to be involved with the advisory committee and I am confident of the future ahead for Snipp.”

CONFERENCE CALL DETAILS:

Snipp management will host a conference call and live webcast for analysts and investors on Wednesday, May 30, 2018 at 10:00AM Eastern Time (US) to discuss the Company’s financial results.

To listen to the live conference call, parties in the United States and Canada should dial 888-224-1005, access code 3745810. International parties should call +1 323-994-2093 using the same access code 3745810. Please dial in approximately 15 minutes prior to the start of the call.

A live and archived webcast of the conference call will be accessible on the “Investors” section of the Company’s website under “Presentations” at www.snipp.com. To access the live webcast, please log in 15 minutes prior to the start of the call to download and install any necessary audio software.

Visit the Snipp website at http://www.snipp.com/ for Snipp’s full suite of solutions and examples of Snipp programs.

Non-GAAP Measures

Snipp uses certain performance measures throughout this document that are not recognizable under Canadian generally accepted accounting principles or IFRS (“GAAP”). These performance measures include Gross Margin and EBITDA. Management believes that these measures provide supplemental financial information that is useful in the evaluation of the Company’s operations.

Investors should be cautioned, however, that these measures should not be construed as alternatives to measures determined in accordance with GAAP and IFRS as an indicator of Snipp’s performance. The Company’s method of calculating these measures may differ from that of other organizations, and accordingly, these may not be comparable.

EBITDA

Snipp defines earnings before interest, taxes, depreciation and amortization (“EBITDA”) as revenue minus operating expenses excluding non-cash operating expenses of stock-based compensation, depreciation and amortization (interest and taxes are not included in the Company’s operating expenses).

Gross Margin

Snipp defines Gross Margin as revenue less campaign infrastructure. The Company’s calculation of Gross Margin is not a financial measure that is recognized under GAAP. Investors should be cautioned that the Company’s defined Gross Margin should not be construed as an alternative measure to other measures determined in accordance with GAAP.

Bookings Backlog

Snipp defines Bookings Backlog as future revenue from existing customer contracts to be recognized in future quarters. Bookings get translated into revenues based on IFRS principles and the Bookings Backlog reflects how revenues in future quarters are steadily being booked today.

The Following are calculations of EBITDA:

| Three Months Ended March 31, 2018 | Three Months Ended March 31, 2017 | |

| USD | USD | |

| Net loss before interest and foreign exchange | (1,041,124) | (1,585,719) |

| Amortization of intangibles | 470,128 | 400,936 |

| Depreciation of equipment | 6,611 | 12,754 |

| Stock-based compensation | 95,683 | 162,421 |

| EBITDA | (468,702) | (1,009,608) |

The Following are calculations of Gross Margin:

| Three Months Ended March 31, 2018 | Three Months Ended March 31, 2017 | |

| USD | USD | |

| Revenue | 2,872,517 | 2,484,308 |

| Less: | ||

| Campaign infrastructure | 1,029,084 | 590,917 |

| Gross Margin | 1,843,433 | 1,893,391 |

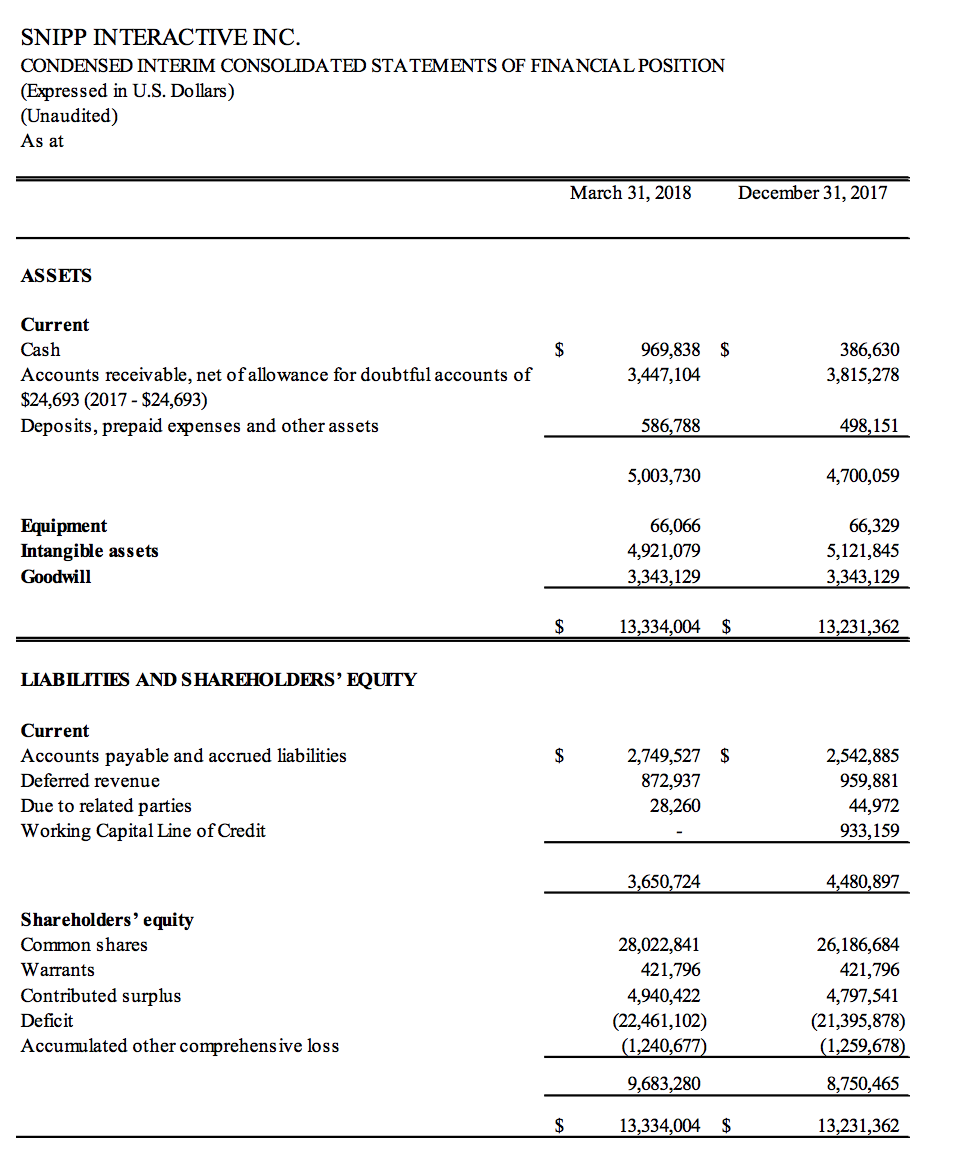

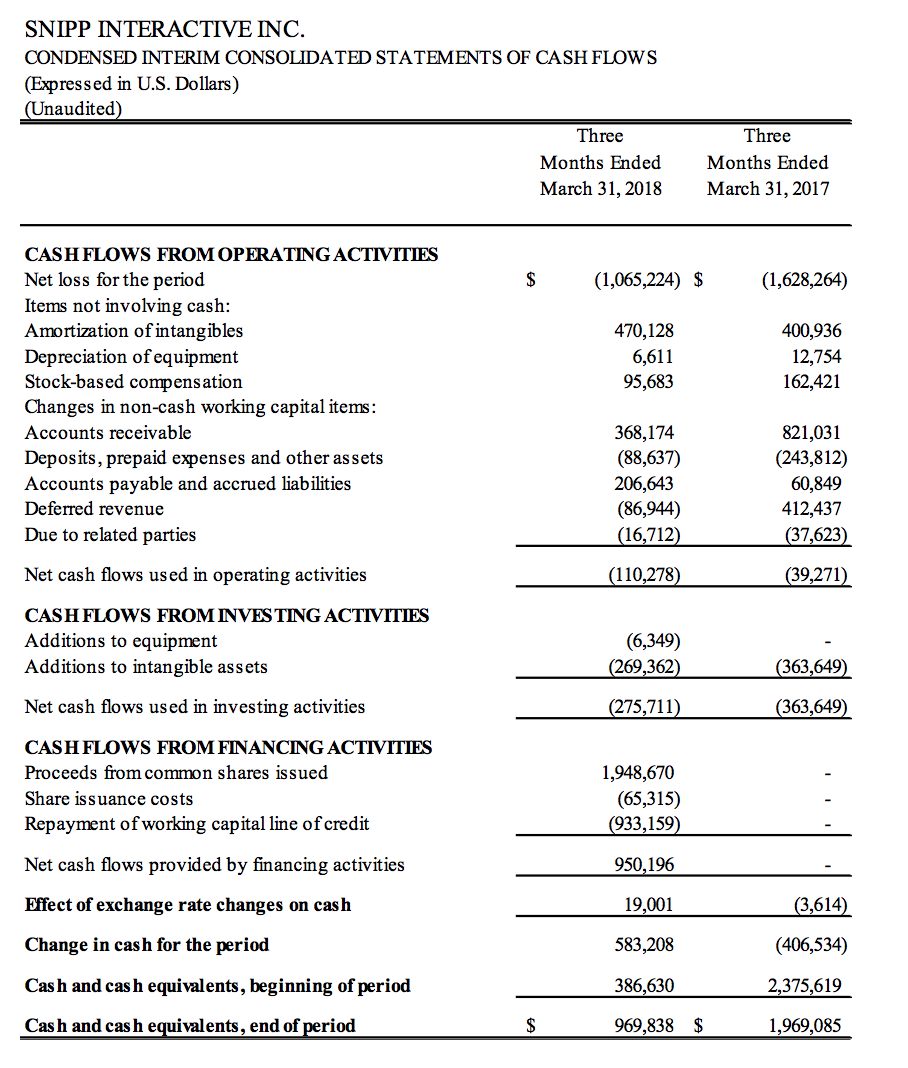

Q1 2018 Financials

About Snipp:

About Snipp:

Snipp is a global loyalty and promotions company with a singular focus: to develop disruptive engagement platforms that generate insights and drive sales. Our solutions include shopper marketing promotions, loyalty, rewards, rebates and data analytics, all of which are seamlessly integrated to provide a one-stop marketing technology platform. We also provide the services and expertise to design, execute and promote client programs. SnippCheck, our receipt processing engine, is the market leader for receipt-based purchase validation; SnippLoyalty is the only unified loyalty solution in the market for CPG brands. Snipp has powered hundreds of programs for Fortune 1000 brands and world-class agencies and partners.

Snipp is headquartered in Toronto, Canada with offices across the United States, Canada, Ireland, Europe, and India. The company is publicly listed on the OTCQB, of the OTC market in the United States of America, and on the Toronto Stock Venture Exchange (TSX) in Canada. Snipp was selected to the TSX Venture 50®, an annual ranking of the strongest performing companies on the TSX Venture Exchange, in 2015 and 2016. SNIPP IS RANKED AMONGST THE TOP 500 FASTEST GROWING COMPANIES IN NORTH AMERICA On Deloitte’s 2017 Technology Fast 500™ List, for the second year in a row.

FOR FURTHER INFORMATION PLEASE CONTACT:

MKR Group, Inc.

Todd Kehrli / Mark Forney

snipp@mkr-group.com

Snipp Interactive Inc.

Jaisun Garcha

Chief Financial Officer

investors@snipp.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions are intended to identify forward-looking statements. Such statements reflect our current views with respect to future events and are subject to such risks and uncertainties. Many factors could cause our actual results to differ materially from the statements made, including those factors discussed in filings made by us with the Canadian securities regulatory authorities. Should one or more of these risks and uncertainties, such as changes in demand for and prices for the products of the company or the materials required to produce those products, labour relations problems, currency and interest rate fluctuations, increased competition and general economic and market factors, occur or should assumptions underlying the forward looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. We do not intend and do not assume any obligation to update these forward-looking statements, except as required by law. The reader is cautioned not to put undue reliance on such forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright Snipp Interactive Inc. All rights reserved. All other trademarks and trade names are the property of their respective owners.